- Andhra Pradesh :- The Essence of Incredible India.

- Arunachal Pradesh :- The Land of Dawnlit Mountains.

- Bihar :- Blissful Biha.

- Chhattisgarh :- Full of Surprises.

- Goa :- A Perfect Holiday Destination.

- Gujarat :- Vibrant Gujarat.

- Haryana :- A Pioneer in Highway Tourism.

- Himachal Pradesh :- Unforgettable Himachal.

- Jammu and Kashmir :- Chalo Kashmir.

- Jharkhand :- A New Experience.

- Karnataka :- One State. Many Worlds.

- Kerala :- God’s Own Country.

- Madhya Pradesh :- The Heart of Incredible India.

- Maharashtra :- Unlimited.

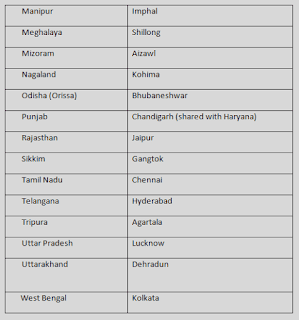

- Manipur :- Jewel of Incredible India.

- Meghalaya :- Half Way To Haaven.

- Nagaland :- Land of Festivals.

- Orissa :- The Soul of Incredible India.

- Punjab :- India Begins Here.

- Rajasthan :- The Incredible State of India.

- Sikkim :- Small But Beautiful.

- Telangana :- It's all in it.

- Tamil Nadu :- Enchanting Tamil Nadu.

- Tripura :- Visit Agartala.

- Uttar Pradesh :- Amazing Heritage Grand Experiences.

- Uttarakhand :- Exploring Uttarakhand.

- West Bengal :- Beautiful Bengal.

- Puducherry :- Give Time a Break.

- Lakshadweep :- 99% fun and 1% land/ Enjoy the coral paradise.

- Dadra and Nagar Haveli :- The Land of Natural Beauty.

For Banking Information Vist Our Website www.reliableacademy.com